Sustainable Financial Products and Services

TOP- Bond Underwriting

- Listing Underwriting

- ESG Fund Sales

- Establishment of the SinoPac+ ESG Evaluation System

- Wealth Management Advisory Services

ESG Fund Sales

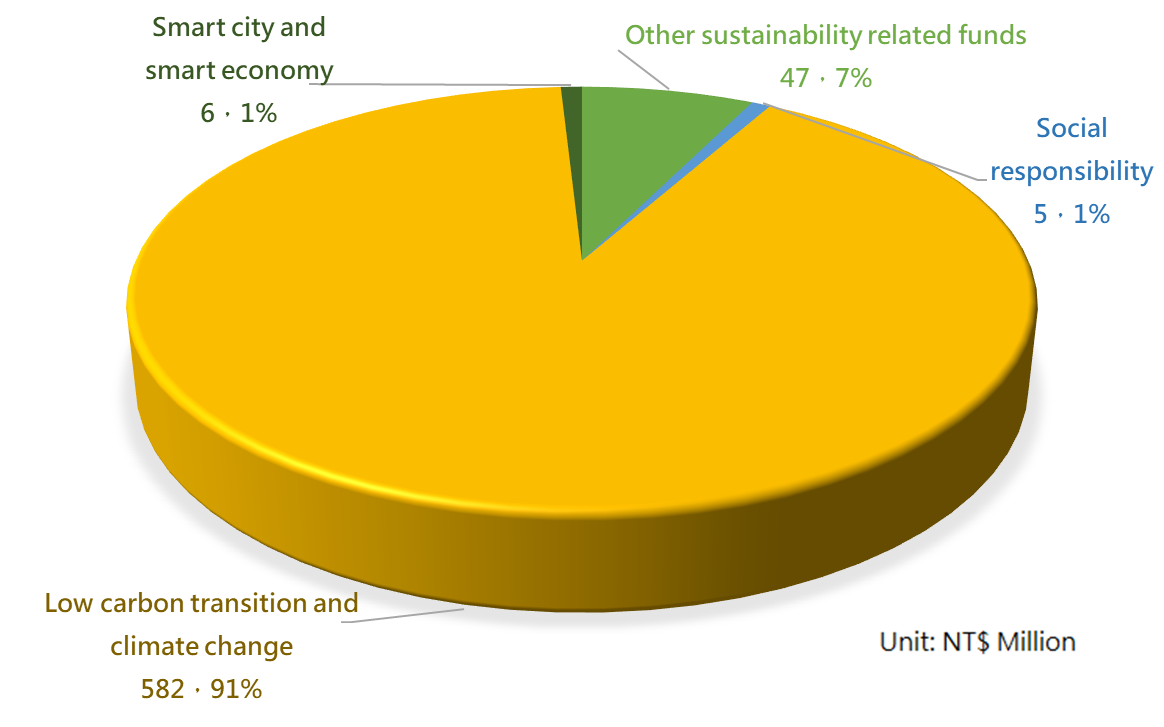

Overall ESG fund sales of SinoPac Securities in 2021 was NT$0.64 billion in 2021. The ESG funds that are sold comply with the European Union's Sustainable Finance Disclosure Regulation (SFDR), promote environmental or social factors, have a positive effect on ESG, or invest in sustainability targets, including eco-friendly funds that focus on green energy, water resources, energy transformation, climate change, and environmental sustainability. The Company also offers funds that promote social responsibility, smart economy, and ESG/sustainability investments, providing wealth management customers with more diverse investment options that take ESG into consideration.

SinoPac Securities promotes and sells ESG funds in the ESG Fund Section, please visit the Rich Club ESG websit.

ESG funds offered in 2021

| Category | Screening principles and explanation (Note) | 2021 sales volume (NT$100 million) |

|---|---|---|

| Low carbon transition and climate change | Includes sustainable energy, energy transformation, water resources, global ecology, climate and environment, global environment, climate change, and global cities funds | 5.82 |

| Social responsibility | Includes social responsibility, sustainable health, and biotechnology funds | 0.05 |

| Smart city and smart economy | Includes sustainable smart economy, smart security, and smart city funds | 0.06 |

| Other sustainability related funds | Sustainability-related funds that do not fall under the three categories above | 0.47 |

Note: Currently, ESG funds are funds defined in Article 8 and Article 9 of the SFDR. In the future, will include ESG funds that meet standards of Taiwan's competent authority and domestic ESG funds.